- December 29, 2022

- Posted by Ruth Mazur

- Tags: Export Invoices from QuickBooks Online, QuickBooks invoice template location

- 0 comment

This Article Will Guide You in the Following Topics:

- Generate invoices in QuickBooks

- Create an invoice in QuickBooks

- Create an invoice in QB Online

- Print invoice in QB Online

- Create an invoice in the QuickBooks menu

- Make invoice

- Print invoices on QB desktop

- Create invoice template in QuickBooks

- Create invoice template in QB desktop

- QB invoice template location

The Premise of Invoicing and Taxation

This article will present you the various important topics regarding the process to generate invoices in QuickBooks. As a year-round process, taxpayers have to abide by the law and comply with the tax. QuickBooks takes responsibility for tax compliance and analysis. This directly lessens the cost and time compared to the previous methods. Intuit’s QuickBooks is designed in such a way that users will find the best value for their money. Invoice is always a complicated process as how you generate, send, and collect is important. How do you manage such a situation? Worry not, we are here to guide you.

QuickBooks Application

QuickBooks is a business accounting platform whereby users can do bookkeeping, taxation, payroll, bank reconciliation, inventory, etc. within a limited budget. This website provides the essential service for the same software. This application across its versions and editions generates a lot of invoices that need easy access and organization. This article is an attempt to provide a guide on how to generate invoices in QuickBooks.

Tax Compliances

The USA businesses have to deposit their taxes every year which are divided into two taxes federal and state taxes. The invoices are a testimony to the amount payable to the government. These invoices (check reprint W-2 in QuickBooks). can later be processed for analysis by trained accountants.

Benefits of Invoicing in QuickBooks

An invoice is a sales receipt that serves as proof of the date of purchase, payer and payee, product IDs, the total amount of the goods or services purchased, and the due date in addition to being used to collect payment from a client or customer. There are advantages of invoicing in QuickBooks, some are:

- Online invoicing is less cost-inducing. When you primarily complete invoicing and payment online, there is less paperwork, less room for error, and less manual data entry.

- It’s efficient. You are likely to receive payment sooner than if you mail an invoice because of the faster payment options via integrated credit card and debit card functionality and instant email delivery.

- Invoices are easy to track. You will be able to keep track of invoices and record your most recent accounts receivable balance because QuickBooks automatically generates and integrates invoices into your recordkeeping. If you don’t command QuickBooks to delete your invoices, it won’t.

How Do I Create An Invoice in QuickBooks Online?

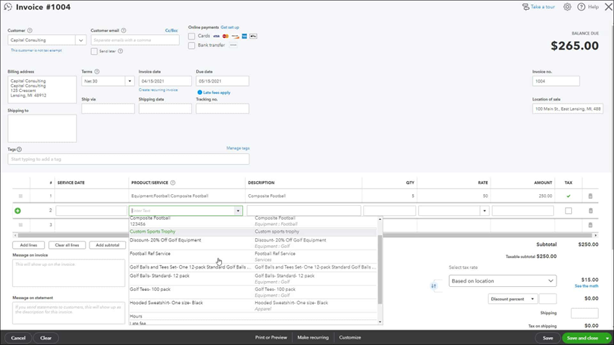

The process to create an invoice in QuickBooks Online is here:

- Choose + New.

- Choose Invoice.

- Select a customer from the dropdown menu under Customers. Ensure their data is all right, particularly their email address.

- Examine the Invoice Date. Change the due date in the Terms dropdown if necessary.

- Select a product or service from the Product/Service column.

- If necessary, enter a quantity, rate, and change amount.

- If you must charge sales tax, check the Tax box.

What Menu Do You Use in QB to Create an Invoice?

Learn here how to create an invoice in the QuickBooks menu. Follow the method below:

- Select the button labeled Create Invoice from the main Sales Orders tab.

- Choose from the available prompt:

- To include all items from the sales order on the invoice, select Create invoice for all of the sales orders.

- If you only want to include some of the items on the invoice, select Create invoice for selected items.

How To Auto-Generate Invoice Numbers?

The process to auto-generate invoice numbers in QuickBooks is:

- Select Accounts and Settings by clicking the Gear Icon in the upper right.

- Click Sales on the left, and then select any location within the Sales form content section.

- Select custom transaction numbers. This adds to invoice no. field to all of your sales forms, where you can then alter the used number to your preference.

- Finally, select Save and then Done.

How Do I Customize an Invoice in QuickBooks Desktop?

To customize an invoice in QuickBooks Desktop, follow the rules below:

- Create or open an invoice.

- Select Settings on the Invoice form. On the Choose what you use panel, select Change what your customers see to decide what company info you want your customers to see.

- Select the Content section.

- Under Forms, select the Form numbers.

- Under Display, select or clear Terms, Shipping, or Due Date checkboxes to add or remove these fields in the form.

- Select the Design section to change the colors, font, and logo.

How Do I create an Invoice for A Vendor?

If you want to create an invoice for a vendor in QuickBooks, then read the scheme below:

- From the Vendors menu, select Enter Bills.

- Select the Credit radio button and enter the Vendor name.

- Go to the Expenses tab, select an Account and enter the Amount.

- Tap Save & Close.

How to Delete Invoices?

If you want to delete an invoice in QuickBooks the steps underneath:

- Find and open the invoice you want to delete.

- In the Invoice window, click More at the bottom.

- Choose either Delete or Void, then click Yes to confirm.

How to Pay an Invoice in QuickBooks?

If the user wants to pay an invoice in QuickBooks, then this is the guide:

- Select + New.

- Select Receive payment.

- Enter the customer’s name and payment date.

- In the Outstanding Transactions section, select an open invoice to apply for the payment. To take a partial payment, change what’s in the Payment field.

- From the Payment method dropdown, select Credit Card.

Can You Create Your Own Invoice?

You can create your own invoice in QuickBooks which has been mentioned in the other parts of the article. Here is a reminder on how to make an invoice in QuickBooks or to access that:

- Navigate to the Sales Tab in Account and Settings

- Create a New Invoice Template

- Customize Your Invoice Template

Print Invoice in QB Online

You can also print the transaction on the Invoices tab.

- Head to the Sales menu and then select Invoices.

- Locate the invoice.

- If the transaction is pre-paid, click on Print.

- If not, click the drop-down arrow under Action, then select Print.

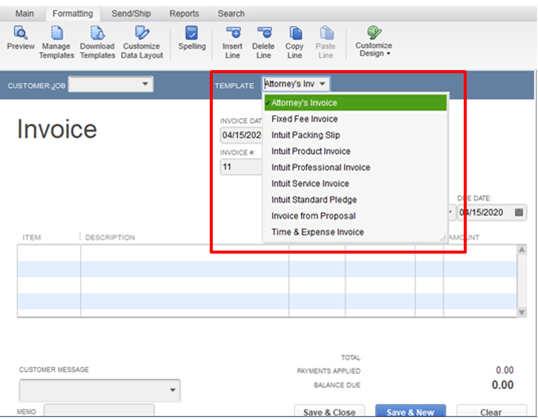

Create Invoice Template

If the users want to create an invoice template in QuickBooks, then follow the mechanism below. If all the urgent fields for an invoice are in a set, users might want a little bit more such as to edit its visual design. QuickBooks allows you to use its editing features, for invoices alongside other provisions like estimates, and sales receipts. There’s a range out of which you can choose your template styles, fonts, and colors.

- Click the gear in the upper right-hand corner

- Find the Company column and click Custom Form Styles

- Click on New Style and select Invoice

- Name the invoice and template

- Click Dive in with New Template (variants like Airy Classic, Modern, Fresh, Bold…)

- Select The Type of Template you want to Use

- Customize Your Logo, Color, and Font as you see fit

- Design the content of your invoice (use the tools of Header, Table, and Footer)

- Customize the Emails tab

- Click Done

QuickBooks Invoice Template Location

Here’s how to find the location:

- Head to the List menu.

- Select Templates.

- Locate your estimate template.

How to create an invoice in QuickBooks for Mac?

If you are taking a piece of this apple, then the correct process to generate an invoice is this:

- Click create Estimates from the Customer menu at the top of the menu bar.

- At Customer, select the customer: select the Job from the drop-down menu, and then fill out the form with the date, item, description, quantity, and so on.

- Click Save.

What are the Things That an Invoice Field Includes?

An invoice would include the following things:

- Custom transaction numbers (allows you to view and change transaction numbers)

- Custom fields (there are three fields for internal or public custom information)

- Service date (adds a service date field)

- Discount (adds a discount field to invoices and sales forms)

- Deposit (adds a deposit field to invoices and sales forms)

- Tips/Gratuity (adds tips and gratuity to invoices and sales forms)

- Shipping (adds shipping fields to invoices and sales forms)

- Invoicing terms and conditions

How to Create and Schedule a Recurring Invoice?

By using QuickBooks to process payments and make invoices, you can scale the process and guarantee accuracy throughout the workflow. The steps to creating a recurring email invoice are listed below.

- Launch QuickBooks and from the main screen, select Invoice from Quick Create.

- Pick a current client or add another one.

- Fill in the required fields for costs, products, and other information.

- Mark the online payment option as ‘On’ for faster payments.

- Click Save and Send.

- The email preview with the option to select the preferred payment method will now appear on the screen.

- Click Send.

How To Export Invoices from QB Online?

Exporting invoices, precisely to export from QuickBooks Online to Excel is a genuine and sometimes a necessary process. To sort information by customer, product ID, transaction amount, or any other information reported on an invoice, you might want to export invoices into Excel. The outlined steps to export invoices from QuickBooks Online to Microsoft Excel are below. Data on the invoices in QuickBooks will remain the same.

- Select Reports from the list of functions.

- Enter the Invoice list at the beginning of the text box and press Enter.

- If you want to filter the reporting or change the range of dates in the report, click Customize.

- Select Export to Excel from the Export function dropdown after customizing the report.

If the invoice transaction numbers do not appear

There are two possible reasons for this:

- The QuickBooks API does not support custom transaction numbers for QuickBooks invoices. Invoices will still be generated in your QuickBooks account when this setting is enabled, but you won’t see an invoice number on the invoice or in your sales invoice grid view.

- If you are not using Custom Transaction Numbers, but an invoice number is not displaying on your invoices, this is a frequent issue to Intuit, that has been resolved.

How To Convert an Estimate to an Invoice?

It’s a usual business-accounting process. Here’s how to do it:

- Hover over Sales in the left menu bar, then click on Customers.

- Click Estimate from the customer’s screen, which is located under the Transaction list tab.

- To convert the estimate into an invoice, click the on Create Invoice button in the upper right corner of the screen.

- On the lower right of the screen, click on the green Save button.

US Edition of QuickBooks

In the US release of QuickBooks, charges are allotted naturally relying upon the client’s area. In this instance, QuickBooks only permits specifying for each invoice line whether tax is enabled or disabled.

Please follow these steps to enable or disable tax for each invoice line:

- In Clerk, add tax; you can leave the description and tax rate blank because they won’t be exported to QuickBooks.

- Enable or disable Tax 1 for each invoice line in Clerk.

- The tax 1 option will define if that line w,./ill be taxable in the exported invoice in QuickBooks.

Conclusion

We hope that this article is informative to you! For more information to create invoices reach out to our contact section. We have a toll-free number 1800-280-5969 as well as a chat process.